For far too long, businesses have relied on traditional, outdated payment methods such as checks. But the times they are a-changin’. A new payment type has come along that will eventually make checks obsolete.

We’re talking about the swift, economic, and versatile ACH payment, and it’s quickly becoming the fastest growing B2B payment type.

There are many advantages to using ACH payment processing. Here are the top 5 reasons you should adopt ACH!

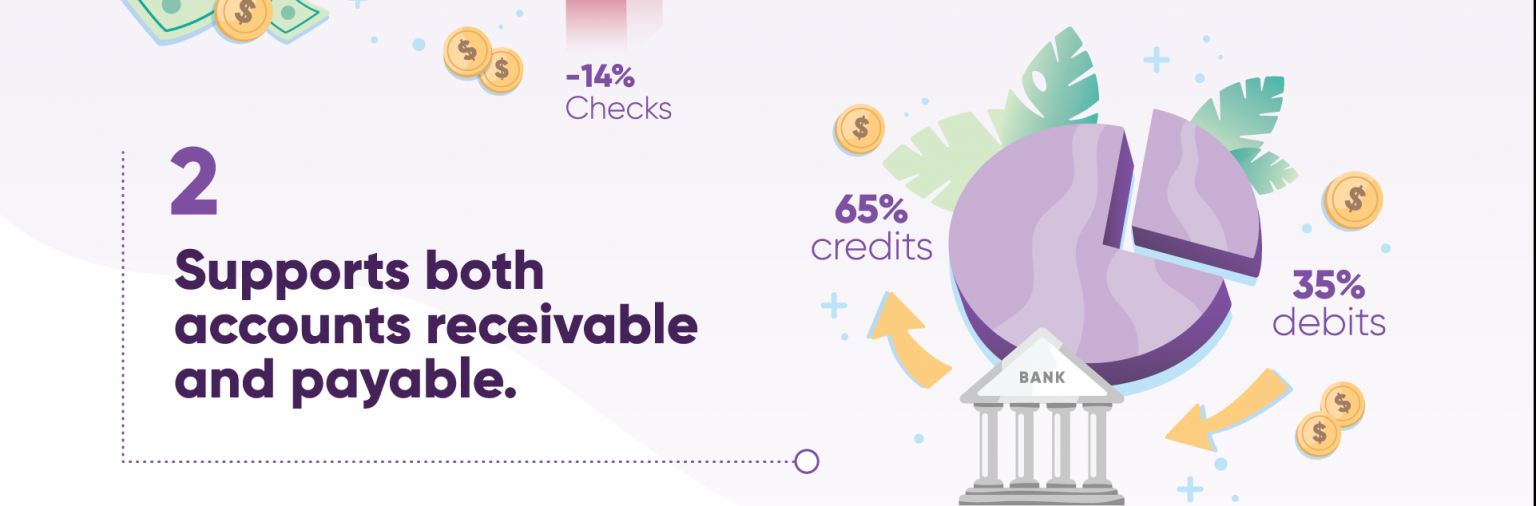

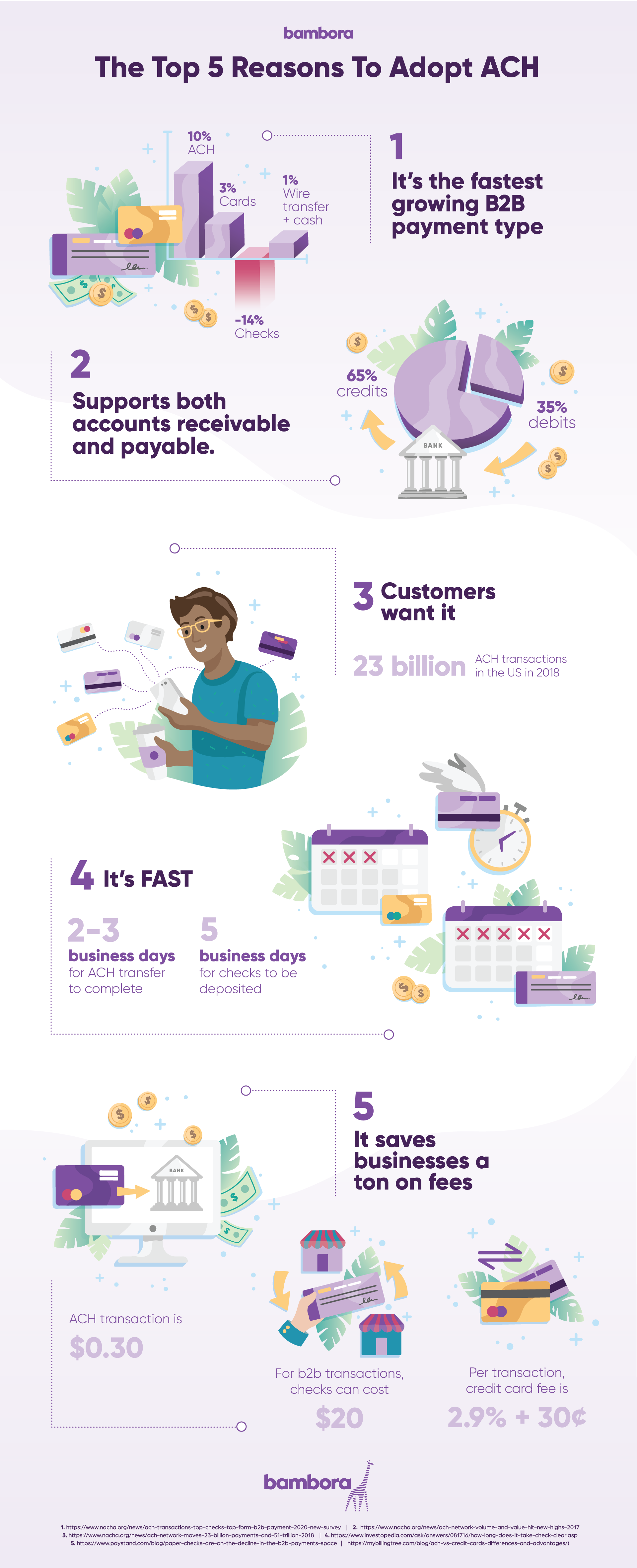

It’s the fastest growing B2B payment type.

Checks are on the way out, and credit card adoption is slowing down. And wire transfers? For those prices, forget about it. More and more businesses are relying on ACH, with adoption growing 10% from 2014-2017.

Customers want it.

From paying bills and invoices to getting paid, the convenience of ACH is making it easier for people to incorporate direct payments in their everyday lives. In 2018 $51.2 trillion in ACH transactions were processed, a 9.5% increase since 2017.

ACH is efficient.

Four days for a transfer to complete is much more enticing than the five business days you get with a check. No more crunch-time runs to the bank to make sure money is sent or received on time.

It works for both credits and debits.

It’s never been easier to pay employees or collect money from clients. ACH debits usually settle the next business day after the transaction has been initiated, and ACH credit settle in one to two business days.

And it can save you a ton on fees.

Why wouldn’t you want to save money when transferring money? Processing fees are lower than credit cards (2.9% + $0.30 per transaction) and much lower than checks (which can run $20!).

If those reasons to adopt ACH aren’t convincing enough, see how batch processing through ACH can impact your business. And don’t hesitate to reach out – we’re here to help.